This is a continuation of the CURRENCY WARS Mark-to-Market post of Fri. Feb. 15, 2013 – Perfect Storm Syndrome

CURRENCY WARS – U.S. in Recession by March 15, 2013, Mark-to-Market Feb. 15, 2013

At this juncture, I’d give a brief background about myself. I’m from the Philippines and therefore it is tempting to ask the G-7 nations, the rest of the G-20, the IMF, World Bank and the UN why not seek the opinion of Filipino oligarchs and their experts? As of June 2012 Forbes Magazine listed the 40 Richest Filipinos with combined net worth of $47.43 Billion. The complete list can be found towards the end of my post:

Zero Sum Game of Global Finance – 5th Edition Dec. 11, 2012

https://www.nedmacario.us/zero-sum-game-of-global-finance-5th-edition-dec-11-2012/

I prepared the post on Dec. 10, 2012, the 2nd death anniversary of my wife Maria Elena G. Macario who I’m sure, like many others, would have lived a longer and more rewarding life commensurate to her abilities and dedication had the Philippines been a Freely Associated State instead of being an abandoned U.S. Territory.**

** – https://www.nedmacario.us/u-s-purchases-annexation-from-1803-to-1899/

She earned an MS degree in petroleum engineer at Stanford University and was involved in the exploration of ALL the known geothermal fields in the whole Philippines. This is the same as discovering ALL THE OIL FIELDS in the Philippines. You’d think it’s good huh? Not in the Philippines which is ruled, to this day, by oligarch-traitors. We have a caste system in the Philippines funded by U.S. taxpayers money through the World Bank.

OPTIMIZING REINJECTION STRATEGY IN PALINPINON, PHILIPPINES BASED ON CHLORIDE DATA

By Ma.Elena G. Macario March 1991

https://pangea.stanford.edu/ERE/research/geoth/publications/techreports/SGP-TR-136.pdf

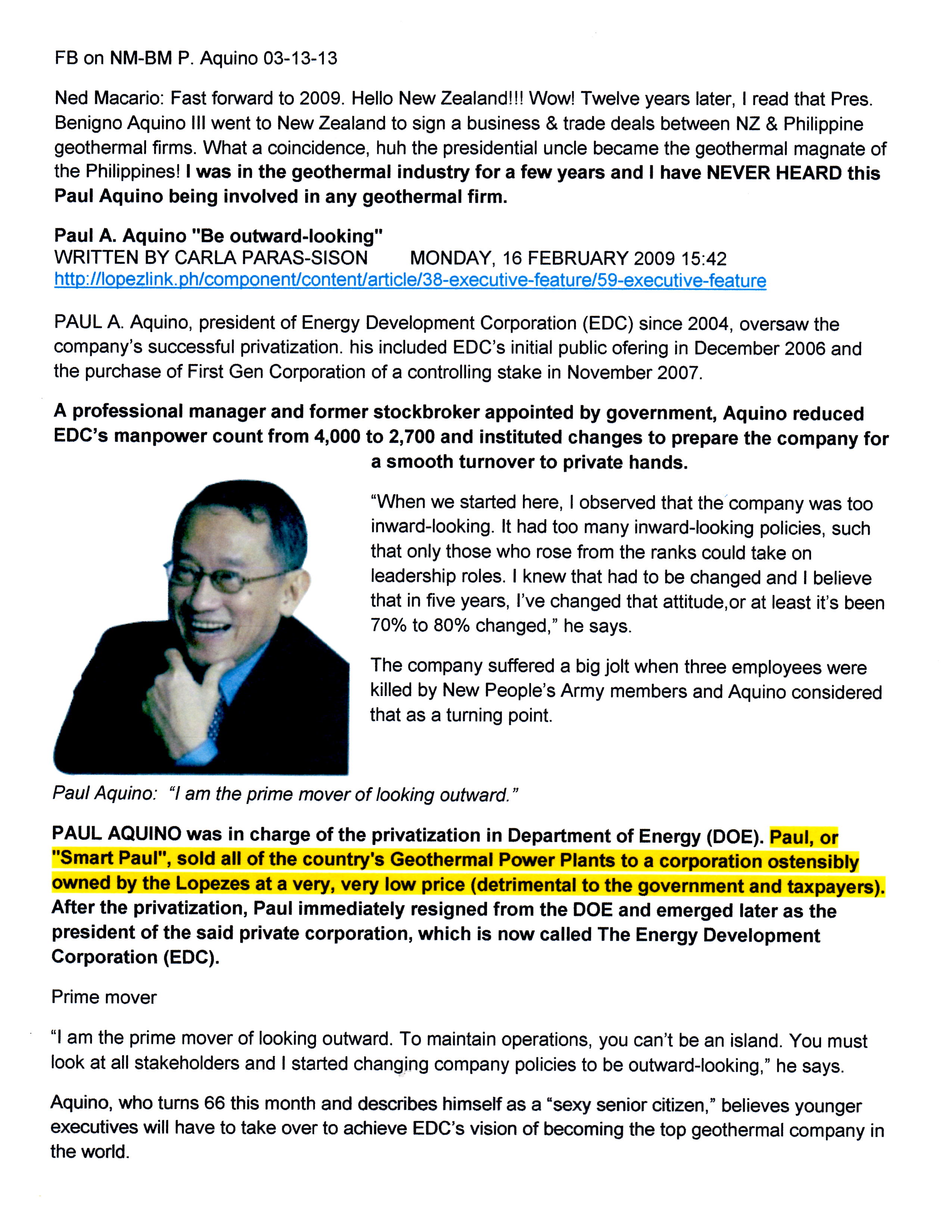

Yet twelve years later, I read that Aquino III went to New Zealand to sign business & trade deals between NZ & Philippine geothermal firms. Coincidentally, the geothermal firms that were started as stated owned corporations during Marcos ended up being owned by oligarch-traitors who are now partners of Cory Aquino’s brother-in-law and Aquino III’s uncle.

Yet twelve years later, I read that Aquino III went to New Zealand to sign business & trade deals between NZ & Philippine geothermal firms. Coincidentally, the geothermal firms that were started as stated owned corporations during Marcos ended up being owned by oligarch-traitors who are now partners of Cory Aquino’s brother-in-law and Aquino III’s uncle.

Paul A. Aquino “Be outward-looking” (Geothermal Magnate) Aquino III Roxas II

WRITTEN BY CARLA PARAS-SISON MONDAY, 16 FEBRUARY 2009 15:42

http://lopezlink.ph/component/content/article/38-executive-feature/59-executive-feature

Paul A. Aquino is the uncle of the Pres. Benigno Aquino III, I have not heard of his name when I was working in the geothermal industry.

Back to the Currency Worries. Here are today’s news:

1.) Japan stocks rally to near four-year highs, yen resumes fall after G20

By Chikako Mogi | Reuters – Monday, February 18, 2013

http://en-maktoob.news.yahoo.com/japan-stocks-rally-yen-resumes-fall-g20-034436959–finance.html

Euro, dollar gain after G20, stocks weaker – Reuters – 15 minutes ago Monday, February 18, 2013 –

TOKYO (Reuters) – Japanese shares surged 2.1 percent on Monday and were on the brink of revisiting four-year highs tapped recently, as the yen slumped after Tokyo dodged direct criticism from G20 peers on its aggressive reflation plans that have weakened the currency.

The G20 opted not to single out Tokyo, but committed members to refrain from competitive devaluations and said monetary policy would be directed only at price stability and growth. Japan said this decision is a green light to pursue its expansionary policies.

“The G20 basically gave tacit approval for currency weakening as a result of monetary easing, and not intervention. So that puts focus on what the BOJ will do next. As long as the BOJ shows its seriousness about stamping out deflation, the yen’s decline will likely be tolerated,” said Citibank Japan chief FX strategist Osamu Takashima.

The dollar gained 0.5 percent to 93.97 yen inching closer to its highest since May 2010 of 94.465 hit on February 11. The euro added 0.3 percent to 125.34 yen, still below its peak since April 2010 of 127.71 yen touched on February 6.

The Nikkei average closed up 2.1 percent as exporters and banks led the pack on the softening yen, after surging as much 2.4 percent earlier to come close to its highest level since September 2008 of 11,498.42 tapped on February 6.

“The G20 effect is already seen in Abe’s general comments on forex today which steered away from giving specifics on a preferred level or direction for the yen,” said Yunosuke Ikeda, a senior FX strategist at Nomura Securities.

====== news abbreviated ============

2.) Lagarde Sees Currency Worries, Not ‘War’

By Katie Holliday I Writer CNBC Asia | CNBC – 1 hour 1 minute ago

Monday, February 18, 2013

Capital Flows

Amid talk of currency wars, some countries have voiced concerns about the impact of currency manipulation on emerging economies’ capital flows – the investment flows in and out of countries.

Officials in both South Korea and India, for example, have publicly spoken out about their concerns about capital flows.

Bank of Korea Governor Kim Choong-soo told the Wall Street Journal on Sunday that he was concerned over the weakening yen’s impact on his country’s economy. The governor stressed the importance of strengthening financial safety nets to give smaller nations the confidence to not have to stockpile currency reserves.

(Read More: South Korea warns it may tighten capital flow controls)

The Reserve Bank of India Governor Duvvuri Subbarao told CNBC on Saturday that he was concerned about exchange rate movements and their impact on capital flows.

The IMF has been finalizing its guidelines for capital flows, Lagarde confirmed.

“Capital flows come and go depending on many factors and there are quite a few drivers of this. We’ve slightly amended our guidelines to take into account both the currency rate and the current account balances and determine whether there’s enough consistency and fair value,” she said.

======== news abbreviated ===========

End of “Currency Worries Not Currency Wars – IMF’s Lagarde – Perfect Storm Syndrome Nonetheless” Post

Bienvenido Macario Feb. 18, 2013