From 1946 to 1950 the US gave the Roxas and Quirino administrations $2 billion dollars for the reconstruction of the Manila and its agricultural sector. A fact finding team from Washington later reported that not a single penny went to the reconstruction or the farming community but it could not be recovered. It was presumed to have been pocketed by the oligarch-traitors and their cronies.

======================

I’m comparing what happened to the Philippines to a man who was wrongfully convicted of a crime he did not commit. Let’s say after DNA test, a man who has ALREADY SERVED 30 YEARS IN PRISON, was found innocent. What do we do? We set the man free. What about the case of the Philippines? We repossess it and grant them Native American status and a Freely Associated State if there is at least one person asking for such. And that’s me!

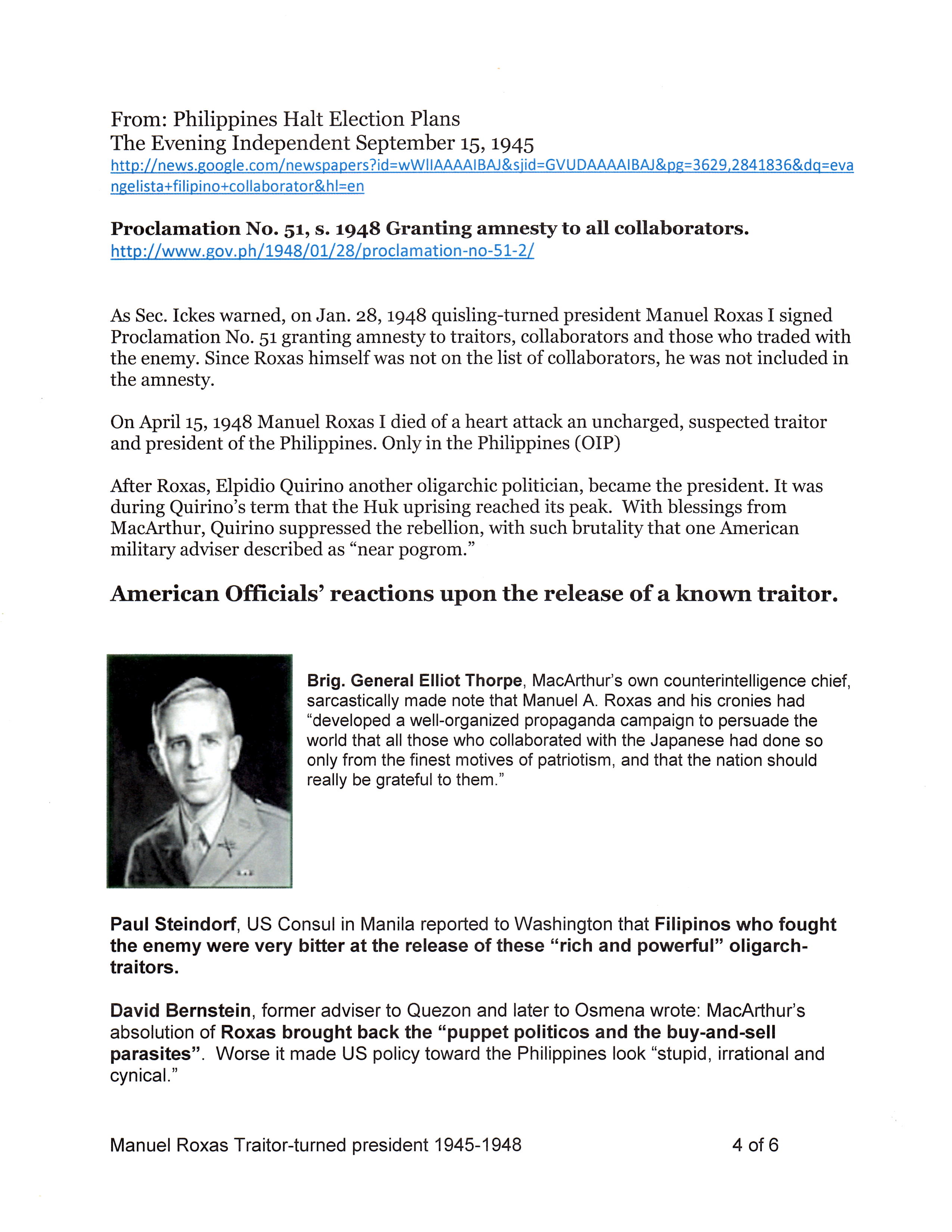

Some reactions when Manuel A. Roxas a known Japanese collaborator was released in April 1945:

Paul Steindorf, US Consul in Manila reported to Washington that Filipinos who fought the enemy were very bitter at the release of these “rich and powerful” traitors.

Brig. General Elliot Thorpe, MacArthur’s own counterintelligence chief, sarcastically made note that Manuel A. Roxas and his cronies had “developed a well-organized propaganda campaign to persuade the world that all those who collaborated with the Japanese had done so only from the finest motives of patriotism, and that the nation should really be grateful to them.”

David Bernstein, former adviser to Quezon and later to Osmena wrote: MacArthur’s absolution of Roxas brought back the “puppet politicos and the buy-and-sell parasites”. Worse it made US policy toward the Philippines look “stupid, irrational and cynical.”

Paul V. McNutt, the last US High Commissioner was equally concerned upon his arrival in Manila in September 1945. He warned Washington that “enemy collaborators” dominated the legislature, and favored postponing independence pending an investigation.

Tom Clark, Truman’s attorney general through his deputy, Walter Hutchinson ordered to study the situation. Hutchinson concluded that the snarl was “one of our own making.” He added that America ought to have dealt directly with the “basic and gigantic problem (with Japanese collaborationists and traitors) rather than buck it to the Filipinos, numbers of whom had themselves been traitors. The US had a duty to “the thousands who died in a sacred democratic cause.

Walter Hutchinson – Atty. Gen.. Tom Clark’s deputy further proposed a war-crime trial presided by Filipino judges or else it was almost a certainty that Roxas would declare an amnesty after his election as president of the independent and sovereign Philippine republic. He would free many big time collaborators like him. ***