Oct. 25, 2016 – We’ve been pouring billions of dollars on the Philippines and things are getting worse!

Had the U.S. bought the Philippines twice over ($40 million) in 1945, it would have been a tropical paradise the envy of the Hawaiian Islands.

Remember after WWII everyone, no exception, everyone in the Philippines were poor. So how did the 50 richest “Filipinos” as listed on Forbes Magazine start amassing.

This Time Magazine Article was from Nov. 6, 1950. Even then Filipino oligarch-traitors who collaborated with the Japanese during WWII were stealing U.S. taxpayers’ money given to the Philippines as war reparations. Let us truly honor those who served and especially those who gave ALL for our freedom. It is our sacred duty to look after what they died for. Please let us forget politics and prosecute corrupt officials in the World Bank, IMF and the UN.

Excerpt: “Although the U.S. has poured some $2 billion into the Philippines since 1945, the new republic is on the verge of bankruptcy.

President Truman’s fact-finding mission (Bell Commission) reported that the money is gone. And obviously it went to landowners and unscrupulous businessmen oligarchs who are now richer than ever while the majority of the people’s standard of living has not risen to anywhere near the pre-war levels.”

THE PHILIPPINES: Bristling Bankrupt

Time Magazine – Monday, Nov. 06, 1950

http://content.time.com/time/magazine/article/0,9171,813694,00.html

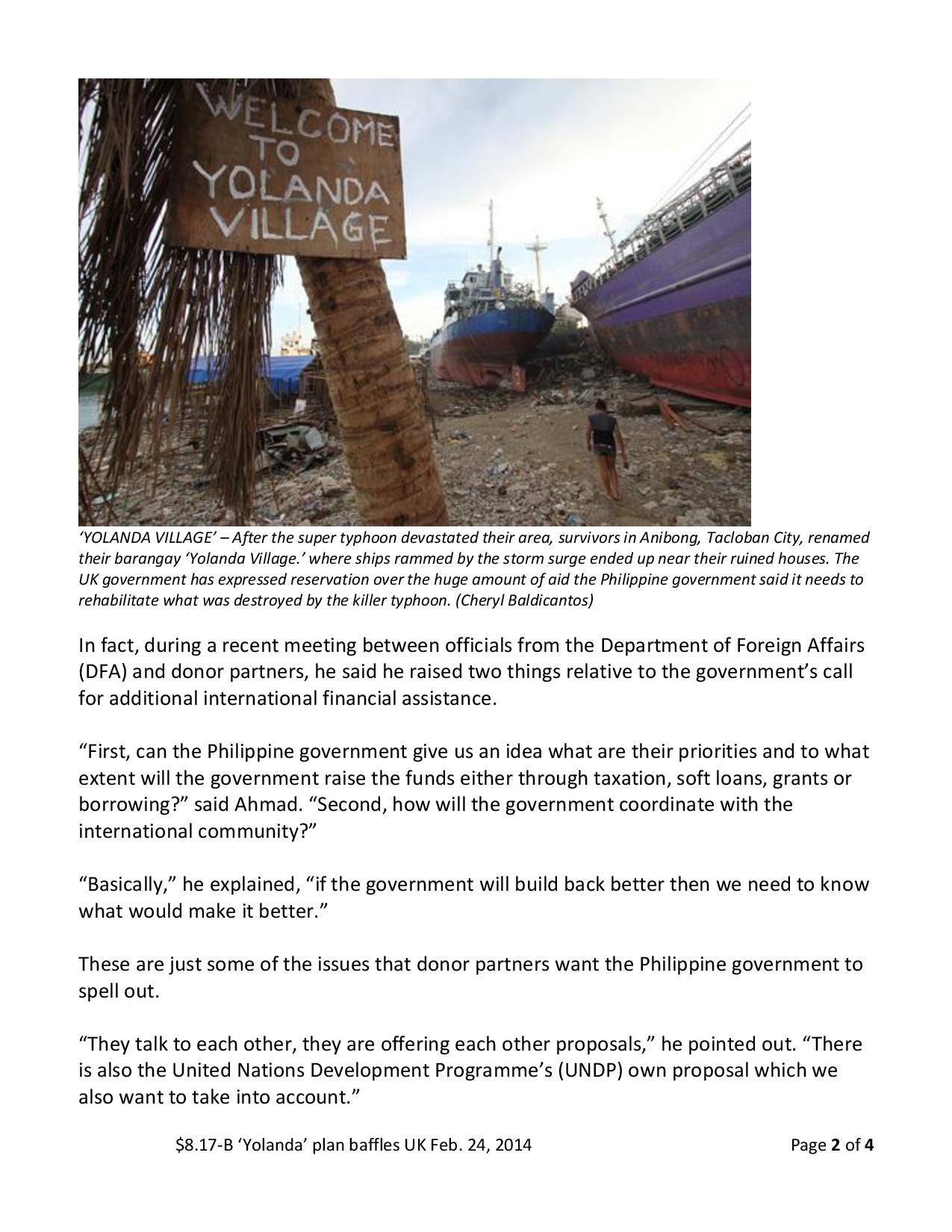

This is the big difference between the World Bank and the US Congress on one hand and the British Foreign Aid on the other. Washington DC NEVER HAS TO ANSWER TO THE AMERICAN TAXPAYER. Maybe one day soon US taxpayers will start to question the US government’s senseless spending OVERSEAS.

“Naturally, as UK’s representative to Manila, Ahmad said HE IS ACCOUNTABLE TO WHAT HIS GOVERNMENT HAS DONE IN THE PHILIPPINES and HOW THEY ARE USING BRITISH PUBLIC MONEY in so far as humanitarian aid for “Yolanda” victims is concerned.”

$8.17-B ‘Yolanda’ plan baffles UK; World Bank, US Congress never held accountable

Huge Aid Package Requires Careful Thinking, Says Envoy

by Roy Mabasa – February 24, 2014 (updated) from Manila Bullentin

http://www.mb.com.ph/8-17-b-yolanda-plan-baffles-uk/