01 JULY 2011 – Here Alan Greenspan is saying US$1.5 TRILLION in CASH (excess cash reserves) has NOT been spent.

01 JULY 2011 – Here Alan Greenspan is saying US$1.5 TRILLION in CASH (excess cash reserves) has NOT been spent.

“Let me tell you why. Not only QE2 but QE1 has not been spent. A trillion and a half dollars, ($1.5 TRILLION) which is excess reserves have, to my estimation, not been spent. The way you can tell that is that the money multiplier, a ratio of the expansion of credit in the commercial banks and the monetary base, which reflects the expansion of the federal reserve balance sheet, that has changed not at all. You can see it in the fact C&I loans are rarely moving. Mortgages, if anything, are weakening in numbers and consumer credit is very dull, so that there is no evidence that huge inflow of money into the system basically worked.”

Alan Greenspan: ‘No Evidence’ Federal Reserve Stimulus ‘Worked’

July 1, 2011 -03:25 pm

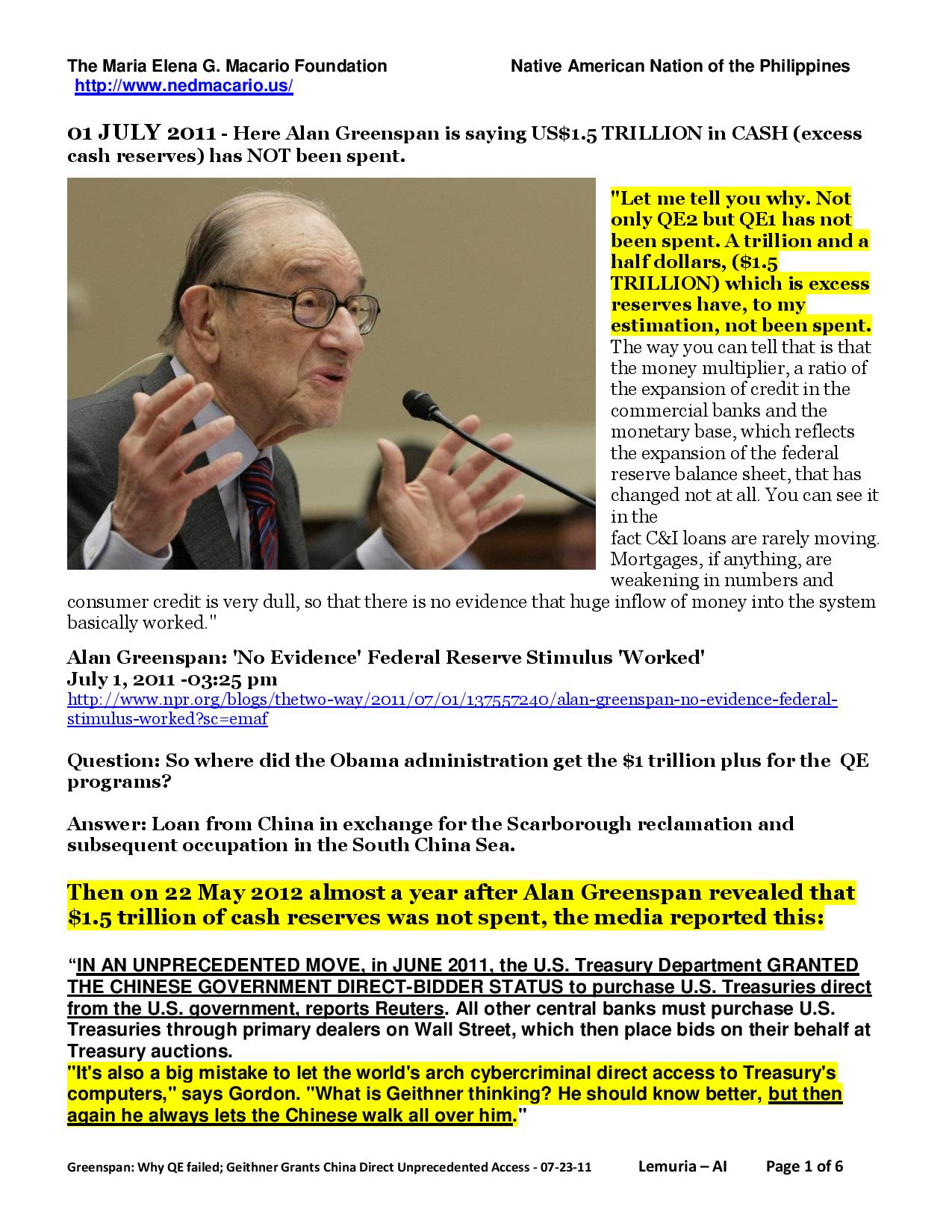

Question: So where did the Obama administration get the $1 trillion plus for the QE programs?

Answer: Loan from China in exchange for the Scarborough reclamation and subsequent occupation in the South China Sea.

Then on 22 May 2012 almost a year after Alan Greenspan revealed that $1.5 trillion of cash reserves was not spent, the media reported this:

“IN AN UNPRECEDENTED MOVE, in JUNE 2011, the U.S. Treasury Department GRANTED THE CHINESE GOVERNMENT DIRECT-BIDDER STATUS to purchase U.S. Treasuries direct from the U.S. government, reports Reuters. All other central banks must purchase U.S. Treasuries through primary dealers on Wall Street, which then place bids on their behalf at Treasury auctions.

“It’s also a big mistake to let the world’s arch cybercriminal direct access to Treasury’s computers,” says Gordon. “What is Geithner thinking? He should know better, but then again he always lets the Chinese walk all over him.”

Do you remember the recent hacking of US federal personnel files including those with security clearance?

(Almost a year ago! Why did we not hear about this until now? Just like the radical Rev. Wright who was Obama’s pastor since 1988 and not heard of it until 2008? How did these happen? Freedom of the press or freedom to suppress info?)

What about the Republicans and Tea Party opposition? Why wouldn’t the GOP raise this issue? Are they in cahoots? Why should I vote for Romney if he is part of the scam or won’t even oppose it?

“What’s Geithner (TG) Thinking?” Treasury Grants China Direct Access to Buy U.S. Bonds

By Stacy Curtin | Daily Ticker – 2 hours 36 minutes ago Tuesday, May 22, 2012

http://www.reuters.com/article/2012/05/21/us-usa-treasuries-china-idUSBRE84K11720120521

In an unprecedented move, in June 2011 the U.S. Treasury Department granted the Chinese government direct-bidder status to purchase U.S. Treasuries direct from the U.S. government, reports Reuters. All other central banks must purchase U.S. Treasuries through primary dealers on Wall Street, which then place bids on their behalf at Treasury auctions.

The People’s Bank of China holds roughly $1.2 trillion in U.S. debt, more than any other entity, and it is now the first foreign government with direct computer access to the U.S. government Treasury auction process. China, however, must sell U.S. Treasuries on the open market.

“It’s a big deal because the Chinese are getting very special treatment,” says Gordon Chang, Forbes columnist and author of the Coming Collapse of China, in an email to The Daily Ticker.

This special treatment does have the potential to save the Chinese government money, but not in transaction and commission costs because primary dealers are prohibited from charging its bidding customers fees. However, China could getting a better deal by keeping its purchases from Wall Street secret.

Not only is China the largest U.S. creditor, it is the largest exporter to this country. The U.S.-China trade deficit widened to $51.8 billion in March up from $45.8 billion in February, growing at the fastest pace in the last ten months, according to the U.S. Commerce Department.

“Unfortunately, by failing to address Chinese mercantilism and resulting trade deficit with China, the United States is getting too deeply in debt to the Middle Kingdom,” says University of Maryland economics professor Peter Morici. “Granting it special status at Treasury is just another example of the policy of appeasement, pursued by both President’s Bush and Obama.”

The change in U.S.-China policy was not disclosed publicly and only discovered recently after Reuters sifted through Treasury documents. But this nondisclosure is not unusual, according to Treasury.

“Direct bidding is open to a wide range of investors, but as a matter of general policy we do not comment on individual bidders,” says Matt Anderson, Treasury spokesperson, in a statement on the matter.

In order to accommodate China, the U.S. Treasury Department had to upgrade its computer system to avoid hacking attempts.

“It’s also a big mistake to let the world’s arch cybercriminal direct access to Treasury’s computers,” says Gordon. “What is Geithner thinking? He should know better, but then again he always lets the Chinese walk all over him.”

In a phone conversation with Treasury’s Anderson, when asked to confirm whether any other government has similar access or about how this change in policy developed, he reverted to Treasury’s aforementioned statement.

Tell us what you think!