July 6, 2014

Steve Forbes in the July 2 Editorial on Forbes Magazine compared Robert McNamara’s handling of the Vietnam War with Hank Paulson’s management of the U.S. Treasury (2006 – 2009).

Towards the start of what would be the Financial Crisis of 2008, on March 4, 2007

U.S.Secretary Hank Paulson said: “Clearly, no one’s got a crystal ball. So there’s always a possibility that there will be a downturn, always a possibility,” Paulson said. “But I don’t see it. I think we have a healthy economy in the U.S.”

On Sunday, March 4, 2007 7:48 PM, B Macario <b_macario@hotmail.com> wrote:

March 4, 2007

====================

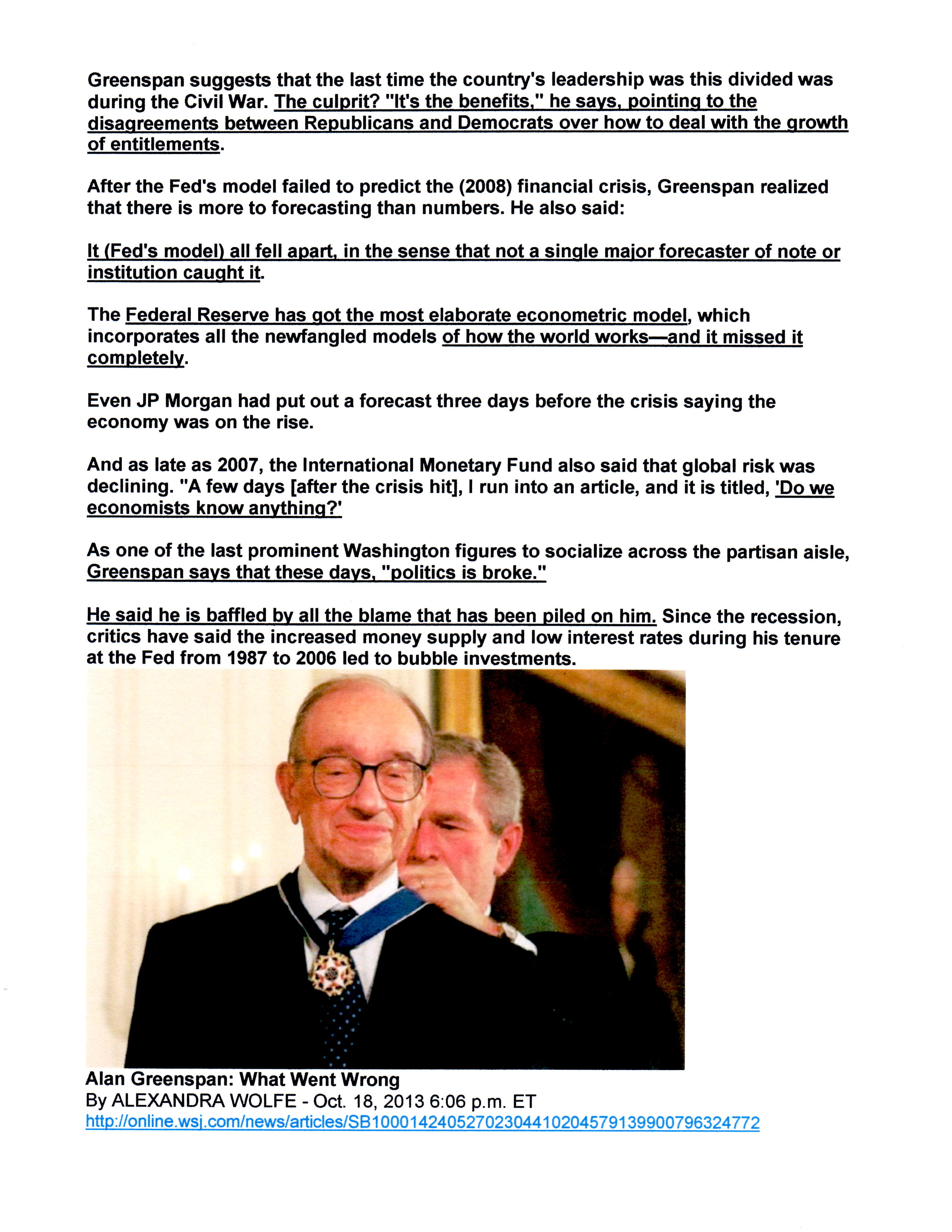

Yet by March 7, 2007, based on the 6-month Financial Analysis (Sept. 2003 to March 2004) I was asking if anyone was interested in a “Crystal Ball” forecasting/prediction system that Alan Greenspan would be looking for in his Oct. 18, 2013 interview.

See: https://www.nedmacario.us/2014/07/05/happy-birthday-america/

Also on May 21, 2004, I wrote Paper No. 8 (Note to Self) predicting which industries and businesses would encounter various problems . See: 5) Paper No. VIII: Original E-mail dated May 21, 2004 updated Fri. Nov. 16, 2012

Paper No. VIII: Original E-mail dated May 21, 2004 updated Friday, Nov. 16, 2012

| Fwd: Re: – Market View from Las Pinas ( Finance This Time ) Crystal Ball Anyone? |

| Bienvenido Macario <laspinassja@yahoo.com> |

Wed, Mar 7, 2007 at 11:03 AM |

> “FINANCIAL ANALYIS: A six-month run.”

>

> The analysis started mid- September 2003 with estimated visible effects to

> become obvious by March 18-25, 2004.

>

> Bienvenido Macario wrote:

>

>

> Date: Mon, 6 Oct 2003 14:48:40 -0700 (PDT)

>

> From: Bienvenido Macario

> > Subject: Re: Personal Inquiry / Request

>

> To:

>

> CC: laspinassja@yahoo.com

>

> Sir:

>

> If FATF and the rest of world could convince the business and powers that be

> in the Philippines to live up to international financial standards which the

> bankers there really have no problem doing, then investments and remittances

> will increase maybe ten-fold.

>

> As long as the Philippine economy could make do with these remittances, the

> economy will stick to this status quo. After all the status quo will never give

> a difficult time for the moneyed families.

>

> When foreign investors found this out, the exodus started.

>

> Just a note on financials (mark-to-trend) In the week of Sept. 15, 2003,

> certain alternatives or courses of action have been put into motion. This would

> definitely affect the stock market worldwide, especially the US market.

>

> In the meantime, world markets would have to react to these stimuli with

> rippling effects to settle sometime in March 2004. I’d say March 18 to 25,

> 2004.

==========================