March 16, 2013

Below is the WAIS post “Is the Euro Overvalued?” dated Feb. 28, 2010. It is my contention that the Euro, compared to the US dollar, is overvalued. Here’s why.

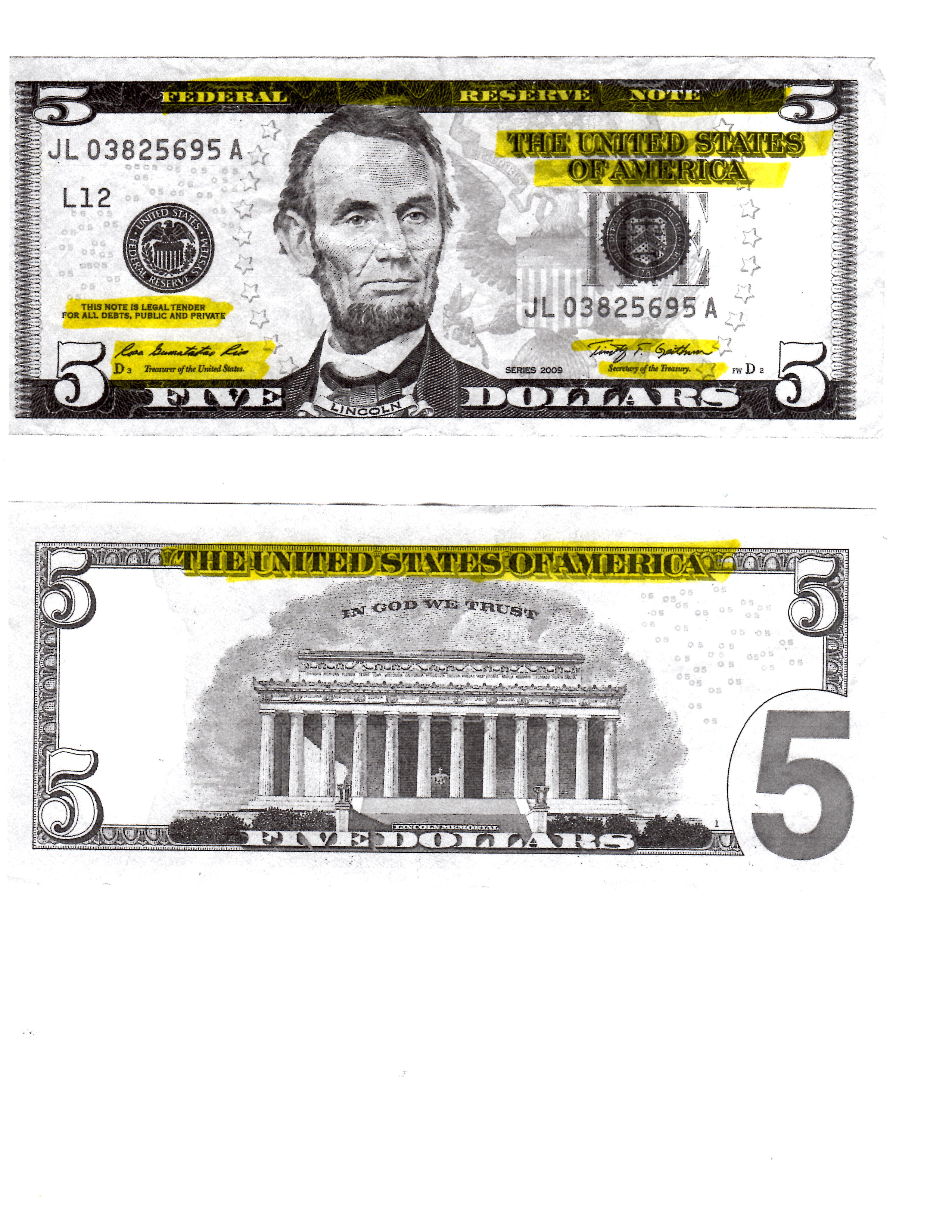

In every US dollar bill the words: “THIS NOTE IS LEGAL TENDER FOR ALL DEBTS PUBLIC AND PRIVATE” could be found. It is in fact a Federal Reserve (Bank) note, signed by the US Treasurer and the Secretary of the Treasury. On the back side of the note reads “THE UNITED STATES OF AMERICA” assures the holder in due course that every dollar bill is backed by the U.S. government.

Posted is an enlarge black & white copy of a US $5 bill. In yellow highlights are the features described above.

Next is the front and back specimen of a €5 bill. Where does it say there that Germany or the more prosperous members of the EU with stable economies will pay the holders of euros in due course? There is no saying what the EU-ECB will do or not do as in the case of the Cyprus bailout.

Granted that it is implied the note has the full backing and support of the EU, how long has the EU been around?

Why revisit this Feb. 2010 WAIS post now? It has something to do with: a.) The prediction that on March 15, 2013 the U.S. will officially be in recession. and b.) the ECB-IMF Cyprus bailout would involve US participation/contribution. It reminded me of the 1930’s collapse of the U.S. banking system. Yesterday’s much delayed bailout that is seen as a beginning of a new trend in bailouts where Cypriot bank depositors were asked to give up to 10% of their savings depending on their balances.

Could the ECB-IMF ask for technical assistance instead of funds from Washington DC? Continuous bailouts have limitations. Sometimes the cure could be worse than the disease.

See: Eurozone Debt Crisis Update: Cyprus’ Savers Suffer In Unprecedented bailout http://www.nedmacario.com/wp-admin/post.php?post=906&action=edit

Bienvenido Macario

Lemuria

Ancora Imparo

IGA

US FIVE DOLLAR BILL